Crypto

Bitcoin hashrate drops 15% from October high as miner capitulation drags into almost 60 days

Key Takeaways (30s Read)

Bitcoin's hashrate has dropped 15%, indicating continuous miner capitulation.

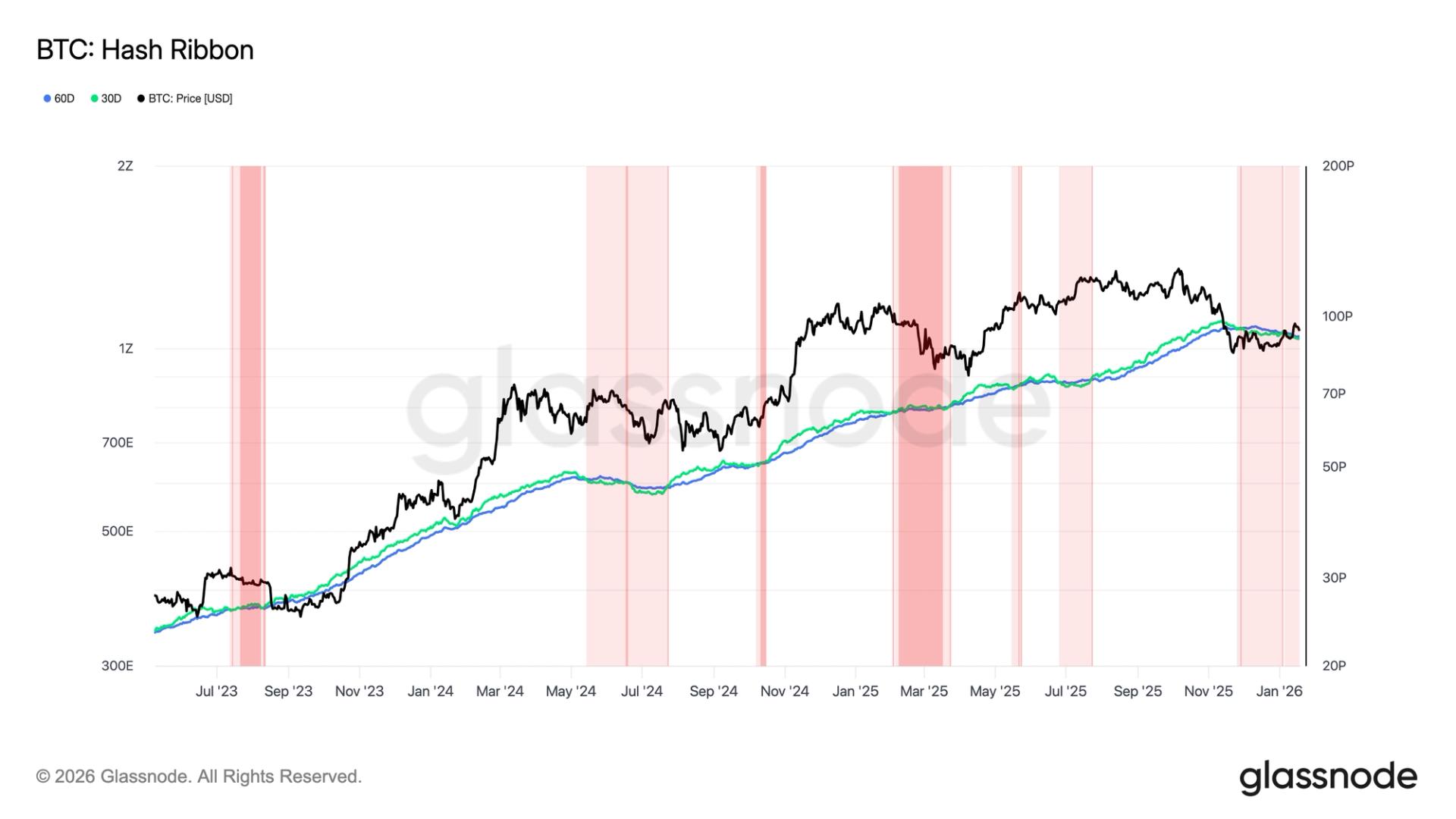

Recent reports indicate that Bitcoin's hashrate has dropped by 15% from its October highs, primarily due to ongoing miner capitulation, which has persisted for nearly 60 days. Additionally, a 4% decline in mining difficulty is projected, marking seven negative adjustments in eight instances.

This scenario raises concerns about how it might affect Bitcoin's supply and overall market sentiment. Miner capitulation can be interpreted as a potential bearish signal for prices and could also impact investor psychology. Furthermore, it may lead to slower block generation rates, raising concerns about the overall health of the network.

Traders should monitor how Bitcoin responds to this trend for insights into future price movements.

AI Analyst

AI Opinion

"The decline in Bitcoin's hashrate is a significant indicator of ongoing miner capitulation. This situation suggests that rising production costs and overall market uncertainty are prompting investors to adopt a risk-averse stance. Moreover, the adjustment in mining difficulty could exacerbate supply-side concerns. With market volatility persisting, investors may need to exercise caution and possibly reassess long-term strategies. Amid these circumstances, implementing proper risk management practices is essential."

RECOMMENDED BROKER Trusted Broker

Maximize This Opportunity.

Turn AI-detected market inefficiencies into profit with industry-leading specs. There's a reason pros choose Exness.

Raw Spreads

0.0 pips~

Leverage

Unlimited

Execution

Instant

AI Market Analysis Team

Combining advanced AI algorithms with professional trader insights. We analyze market drivers 24/7 to provide objective trading scenarios.

USDJPY

USDJPY EURUSD

EURUSD