Crypto

Bitcoin spot demand builds as short squeeze risk increases

Key Takeaways (30s Read)

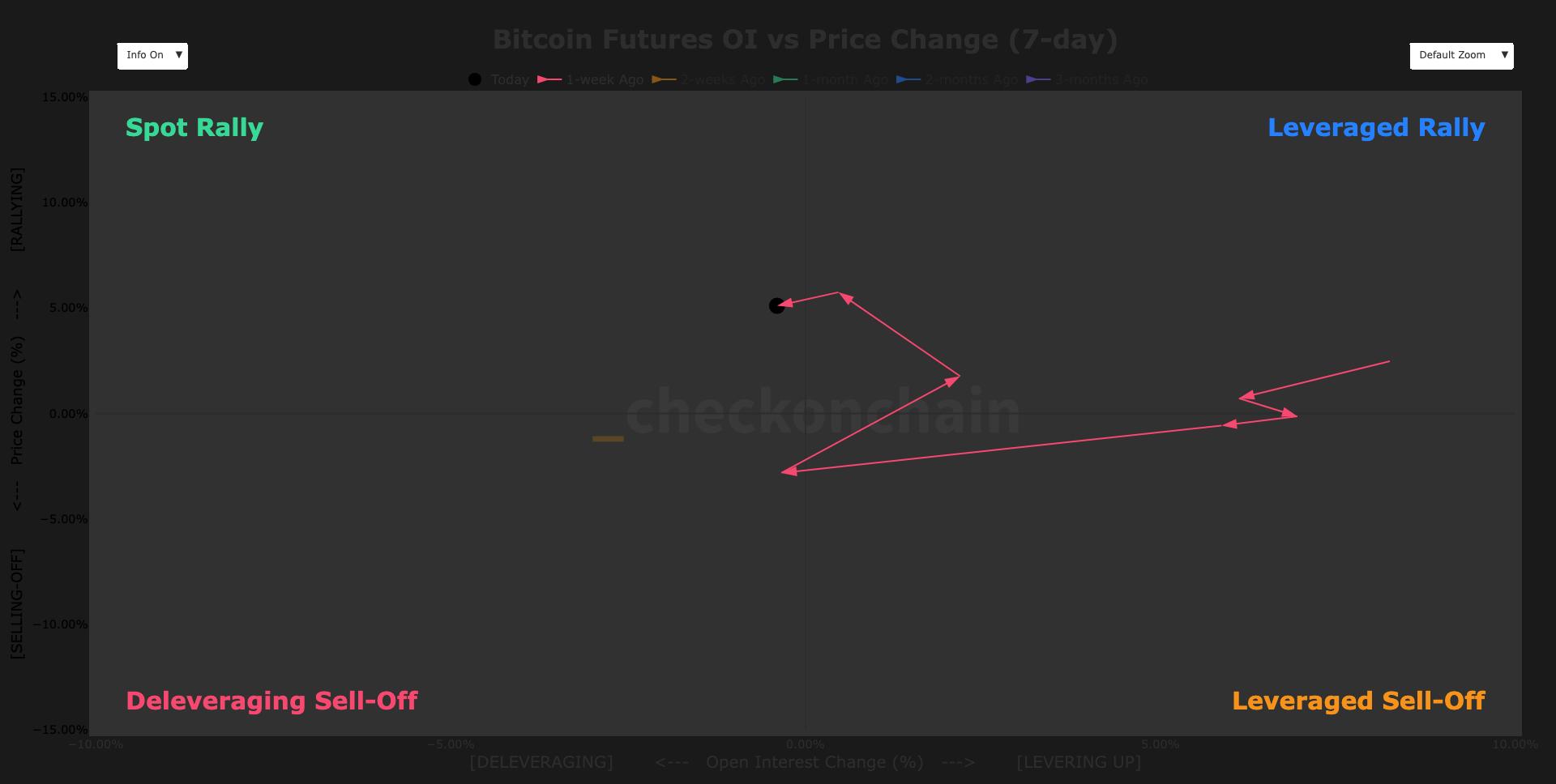

Spot demand for Bitcoin is increasing as short squeeze risks heighten.

In early 2026, Bitcoin's supply and demand dynamics appear to be improving, driven by positive on-chain and derivatives data. Spot market demand is notably increasing, coupled with heightened risks for traders holding short positions, who may face a squeeze from a rapid price rise. This backdrop predicts a potential price surge, prompting traders to closely monitor the market's progression.

Market responses indicate a growing number of traders taking bullish positions, which can further drive the prices upwards. In the coming weeks, as position adjustments occur, it will be critical to observe how prices evolve and adapt trading strategies accordingly. Maintaining focus on the market context will be essential moving forward.

AI Analyst

AI Opinion

"The Bitcoin market shows indications of improving supply and demand dynamics, with short squeeze risks becoming increasingly tangible. Amid rising concerns about rapid price increases, many traders are beginning to explore bullish positions. However, the potential for increased volatility means that risk management becomes crucial. Investors must closely observe price patterns and market trends, and consider strategies to mitigate risks beforehand. While the market displays a bullish stance in the short term, whether it can sustain stable growth over the long haul remains to be seen."

RECOMMENDED BROKER Trusted Broker

Maximize This Opportunity.

Turn AI-detected market inefficiencies into profit with industry-leading specs. There's a reason pros choose Exness.

Raw Spreads

0.0 pips~

Leverage

Unlimited

Execution

Instant

AI Market Analysis Team

Combining advanced AI algorithms with professional trader insights. We analyze market drivers 24/7 to provide objective trading scenarios.

USDJPY

USDJPY EURUSD

EURUSD