Crypto

Long-term holders turn net accumulators, easing a major bitcoin headwind

Key Takeaways (30s Read)

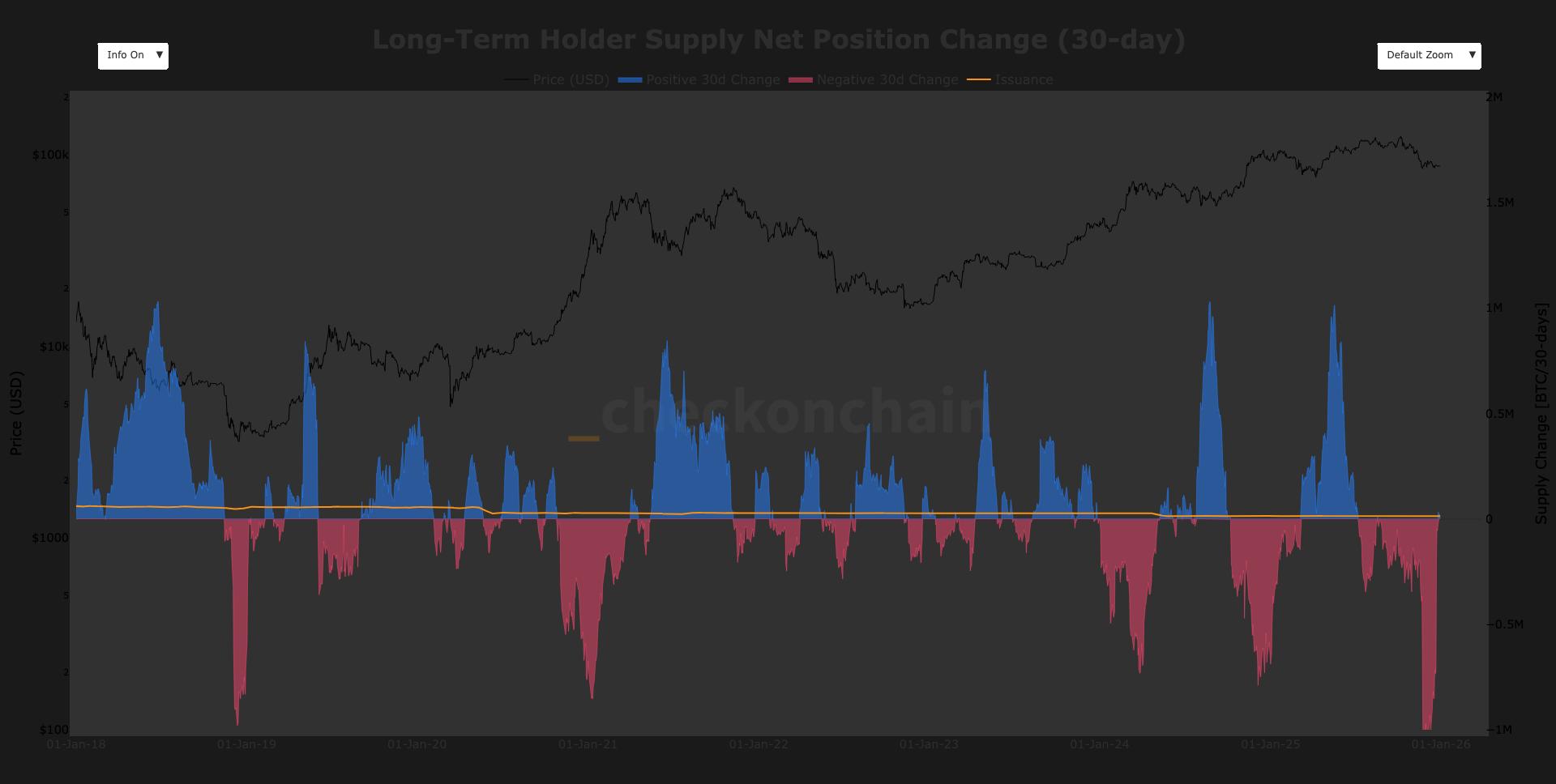

Long-term Bitcoin holders are becoming net accumulators, easing sell pressure.

Bitcoin market has gained attention as long-term holders have sold over 1 million BTC during the recent correction, marking the largest sell pressure from this cohort since 2019. However, they are now becoming net accumulators, suggesting an important turning point for the Bitcoin market. This shift may ease the selling pressure and have a positive impact on Bitcoin's price. Particularly, a rebound after such sell-offs can enhance investor confidence and prepare for future price hikes. In the long term, the accumulation by long-term holders may improve market stability, making it crucial to monitor this data closely.

AI Analyst

AI Opinion

"The recent trend in the Bitcoin market reflects a complex interplay of short-term sell pressure followed by renewed investments from long-term holders, suggesting factors that could influence market confidence. The sale of over 1 million BTC is significant, but the consequent net accumulation indicates that these holders are looking at the future of Bitcoin. Hence, market participants must consider not only short-term volatility but also long-term value. Additionally, macroeconomic conditions and regulatory changes may also significantly impact this trend, necessitating a careful watch."

RECOMMENDED BROKER Trusted Broker

Maximize This Opportunity.

Turn AI-detected market inefficiencies into profit with industry-leading specs. There's a reason pros choose Exness.

Raw Spreads

0.0 pips~

Leverage

Unlimited

Execution

Instant

AI Market Analysis Team

Combining advanced AI algorithms with professional trader insights. We analyze market drivers 24/7 to provide objective trading scenarios.

USDJPY

USDJPY EURUSD

EURUSD