Crypto

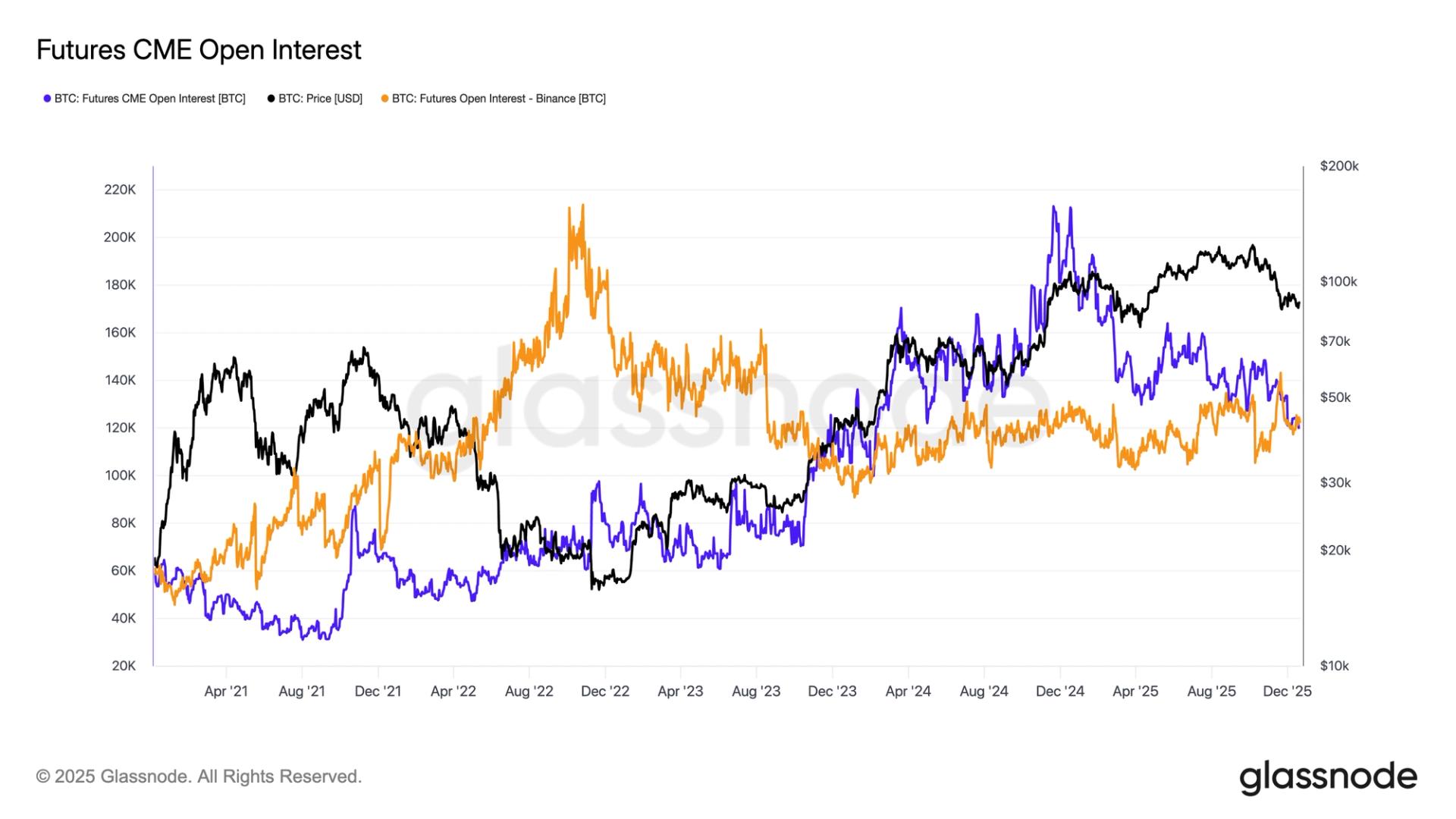

CME loses top spot to Binance in bitcoin futures open interest as institutional demand wanes

Key Takeaways (30s Read)

CME loses its top position in Bitcoin futures open interest to Binance as institutional demand declines.

CME losing its top position in Bitcoin futures open interest to Binance highlights a decline in institutional demand in the cryptocurrency market. This shift is due to a sharp drop in the profitability of basis trading, where traders aim to capture spreads by buying spot Bitcoin and selling Bitcoin futures. Amidst declining institutional participation, competition between exchanges has intensified, making Binance's platform more attractive for liquidity. This trend may impact Bitcoin market volatility and investor sentiment, offering significant insights into the future direction of the market.

AI Analyst

AI Opinion

"The decline in institutional participation in the current market environment may impact Bitcoin price stability. The shift in CME's position indicates a change in liquidity perception and market engagement. While Binance's acquisition of liquidity can potentially invigorate Bitcoin trading, the intensified competition may deter higher-profile investors. This dynamic poses risks of increased price volatility, making it crucial for investors to stay vigilant regarding short-term price movements. Portfolio reassessment and risk management will be key for navigating this evolving landscape."

RECOMMENDED BROKER Trusted Broker

Maximize This Opportunity.

Turn AI-detected market inefficiencies into profit with industry-leading specs. There's a reason pros choose Exness.

Raw Spreads

0.0 pips~

Leverage

Unlimited

Execution

Instant

AI Market Analysis Team

Combining advanced AI algorithms with professional trader insights. We analyze market drivers 24/7 to provide objective trading scenarios.

USDJPY

USDJPY EURUSD

EURUSD