GOLD

Gold wins the debasement trade in 2025, but it is not the full story

Key Takeaways (30s Read)

An analysis of gold's investment trends in 2025, highlighting bitcoin ETF developments.

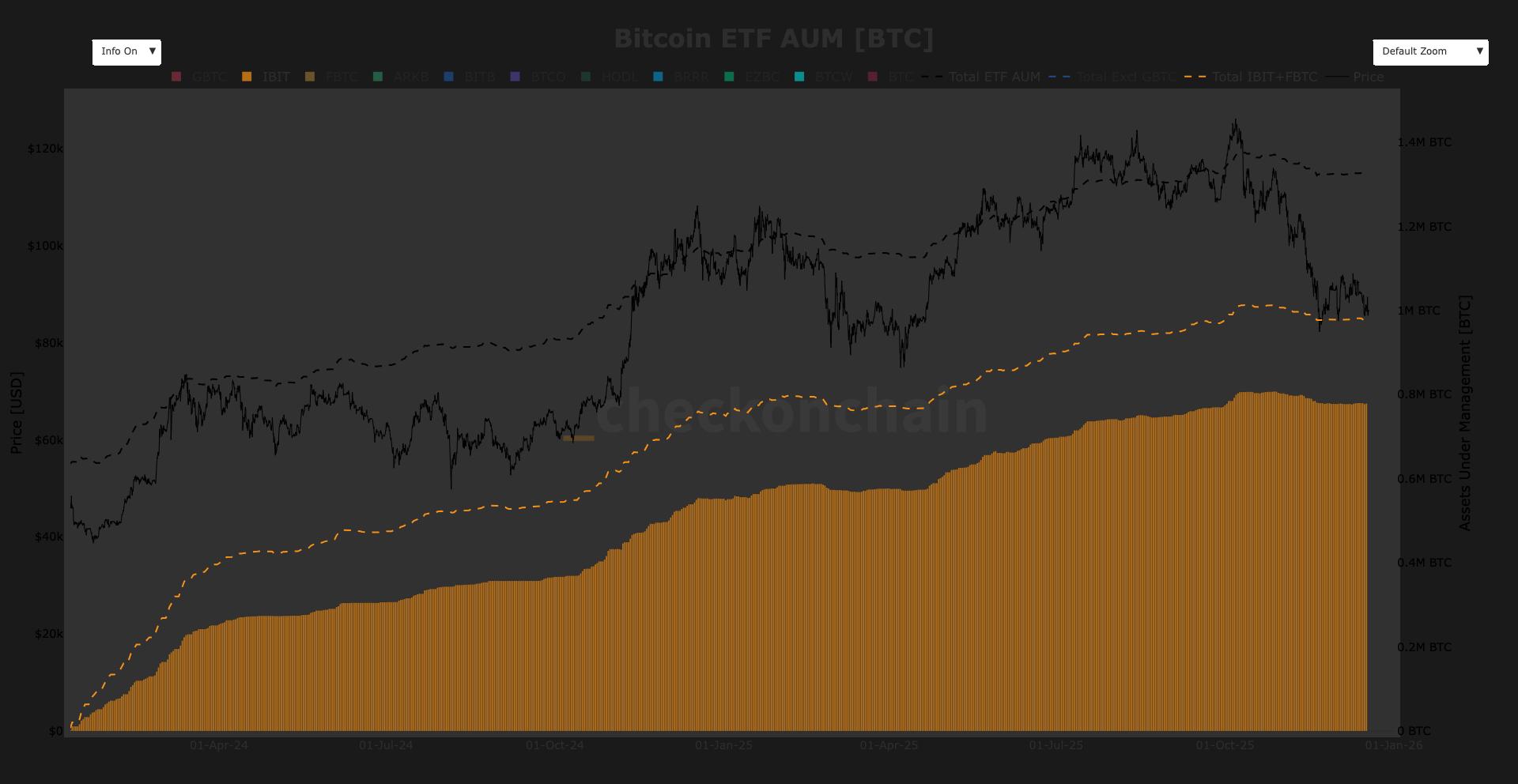

Gold has triumphed in the debasement trade of 2025; however, the broader narrative is complex. The U.S. bitcoin ETF's assets under management saw a decline of less than 4%, despite a significant 36% price correction from the highs in October. This highlights the stability of bitcoin as an investment and the growing role of gold as a safe haven and inflation hedge. The dynamics suggest that traders should keep a close eye on movements in the gold market while strategizing their positions.

AI Analyst

AI Opinion

"In the current market context, gold is solidifying its status as a defense mechanism against inflation and financial uncertainty. While bitcoin ETFs are demonstrating relative stability, demand for gold continues to rise due to its characteristics as a safe haven asset. There is potential for gold prices to increase further in the future, necessitating a reassessment of trading strategies and the exploration of new opportunities. Key risks include movements in interest rates and geopolitical uncertainties, which market participants should watch closely."

RECOMMENDED BROKER Trusted Broker

Maximize This Opportunity.

Turn AI-detected market inefficiencies into profit with industry-leading specs. There's a reason pros choose Exness.

Raw Spreads

0.0 pips~

Leverage

Unlimited

Execution

Instant

AI Market Analysis Team

Combining advanced AI algorithms with professional trader insights. We analyze market drivers 24/7 to provide objective trading scenarios.

USDJPY

USDJPY EURUSD

EURUSD