Crypto

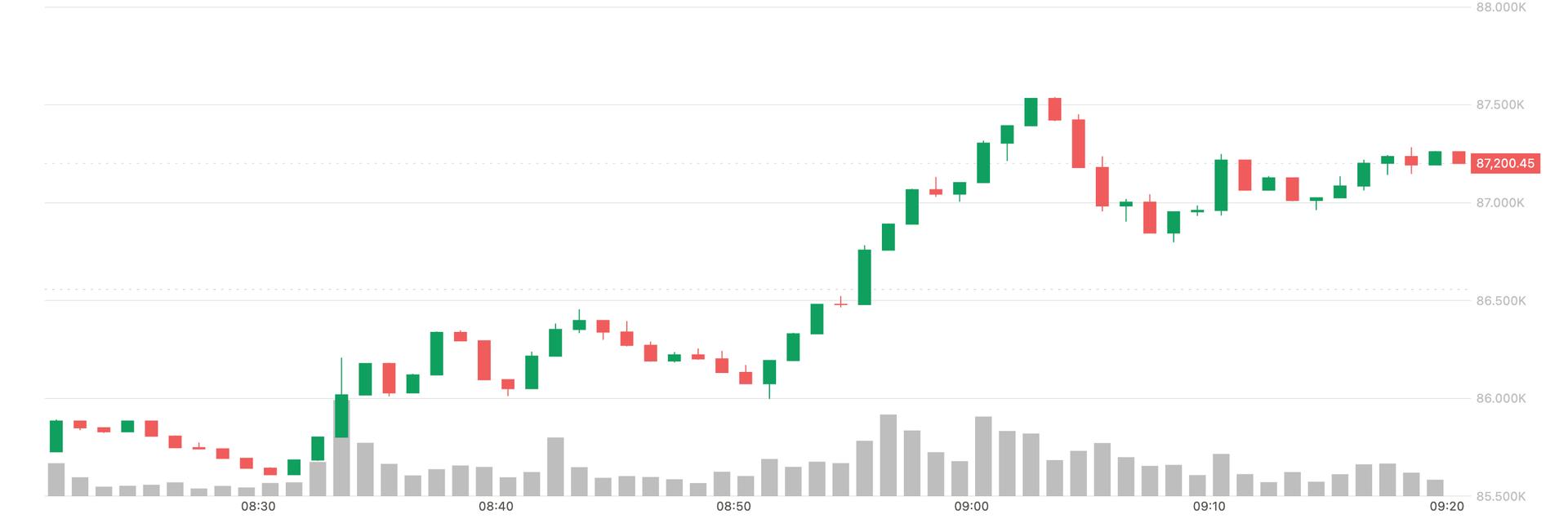

Bitcoin jumps above $87,000, yen slides as Bank of Japan hikes interest rates

Key Takeaways (30s Read)

Bitcoin surpasses $87,000 as the Bank of Japan raises interest rates.

The Bank of Japan raised its short-term policy rate by 25 basis points to 0.75%, marking the highest level in nearly 30 years. This has notably impacted the markets, contributing to a decline in the Japanese yen. Simultaneously, Bitcoin has surged above $87,000 in response to the news. The rate hike is likely to influence investor sentiment, potentially boosting demand for Bitcoin and other cryptocurrencies. The current market conditions suggest a dynamic trading environment with expectations of further yen depreciation and Bitcoin appreciation.

AI Analyst

AI Opinion

"The Bank of Japan's rate hike signals a significant shift in the financial landscape. With interest rates reaching historical highs, concerns are arising about the depreciation of the yen against major currencies. This weakening could lead Japanese investors to seek opportunities in overseas assets, potentially boosting the demand for Bitcoin. Such factors might drive prices upwards even more. Nonetheless, this volatility comes with risks, and investors should stay alert to market fluctuations and external economic influences."

RECOMMENDED BROKER Trusted Broker

Maximize This Opportunity.

Turn AI-detected market inefficiencies into profit with industry-leading specs. There's a reason pros choose Exness.

Raw Spreads

0.0 pips~

Leverage

Unlimited

Execution

Instant

AI Market Analysis Team

Combining advanced AI algorithms with professional trader insights. We analyze market drivers 24/7 to provide objective trading scenarios.

USDJPY

USDJPY EURUSD

EURUSD